Mobikwik Unlisted Shares

Industry: Financial | Sector: Services | Depository: NSDL, CDSL

₹ 5,152.00

Key Indicators

| Key Indicators | 2024 |

|---|---|

| Current Share Price | 5,152.00 |

| Face Value | Share | 2.00 |

| Book Value | Share | 28.50 |

| Price To Earning (PE) | 266.80 |

| Price | Sales | 4.20 |

| Price | Book | 23.10 |

| Outstanding Shares (Crores) | 5.71 |

| Market Cap (Rs. Crores) | 3,747.19 |

| Debt | Equity | 4.30 |

| Dividend | Share | 0.00 |

| Dividend % (On Current Market Price) | 0.0% |

| Return on Total Assets | 1.7% |

| Return on Equity | 8.9% |

| Return on Working Capital | 4.6% |

* Ratio is calculated based on latest financial & current share price.

About The Company

ONE MOBIKWIK SYSTEMS LIMITED (formerly known as ONE MOBIKWIK SYSTEMS PRIVATE LIMITED) (“the Holding Company” or “the Company”) was incorporated on 20 March 2008 under the Companies Act, 1956. The registered office and corporate office of the Holding Company are situated in Gurugram, Haryana. The principal place of business of the Group is in India. They are a fin-tech company - one of the largest mobile wallets (MobiKwik Wallet) and Buy Now Pay Later (BNPL) players in India based on mobile wallet GMV and BNPL

Pricing Trend

Financial Summary

Revenue Growth %

EBITDA Margin %

NET Margin %

Profit & Loss Summary

(All Amount in ₹ Crores)

| PROFIT & LOSS | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Revenue | 890.3 | 561.1 | 543.2 | 302.3 | 369.9 | 160.4 | 85.7 |

| Expense | 853.1 | 617.0 | 652.5 | 404.1 | 454.5 | 293.1 | 287.8 |

| EBITDA | 37.2 | -55.9 | -109.3 | -101.8 | -84.6 | -132.7 | -202.2 |

| Other Cost | 23.1 | 24.7 | 6.9 | 8.4 | 13.4 | 8.1 | 2.7 |

| Profit Before Taxes | 14.1 | -80.6 | -116.2 | -110.2 | -98.0 | -141.0 | -204.9 |

| Tax Expense | 0.0 | 3.2 | -0.3 | 1.0 | 1.9 | -3.2 | -1.9 |

| Profit after Taxes | 14.1 | -83.8 | -115.9 | -111.3 | -99.9 | -137.8 | -203.0 |

| Other Income | Exp. | 0.4 | 0.4 | 0.0 | 0.3 | 0.7 | 0.0 | 0.0 |

| Income (Net Of Taxes) | 14.5 | -83.4 | -115.9 | -111.0 | 99.2 | -137.8 | -203.0 |

| Outstanding Share | 5.7 | 5.7 | 5.6 | 5.0 | 4.9 | 1.0 | 1.0 |

| Earning per Share (Rs | Share) | 2.5 | -14.7 | -23.0 | -22.2 | -20.4 | -137.7 | -202.9 |

| Revenue Growth % | - | -37% | -3.2% | -44.3% | 22.4% | -56.6% | -46.6% |

| EBITDA Margin % | 4.2% | -10% | -20.1% | -33.7% | -22.9% | -82.7% | -235.9% |

| Net Margin % | 1.6% | -14.9% | -21.3% | -36.7% | 26.8% | -85.9% | -236.9% |

| Earning per Share Growth % | - | -688% | 56.5% | -3.5% | -8.1% | 575% | 47.3% |

Balance Sheet

(All Amount in ₹ Crores)

| Balance Sheet | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Cash & Cash Equivalent | 92.9 | 93.7 | 384.2 | 60.3 | 8.7 | 199.5 | 210.3 |

| Non Current Asset | 164.5 | 163.6 | 176.7 | 69.6 | 27.3 | 23.1 | 9.0 |

| Current Asset | 597.2 | 457.0 | 275.2 | 293.3 | 293.3 | 106.8 | 92.2 |

| Total Asset | 854.6 | 714.3 | 836.1 | 423.1 | 337.9 | 329.4 | 311.5 |

| Equity Share Capital | 11.4 | 11.4 | 11.4 | 1.0 | 1.0 | 13.7 | 13.4 |

| Reserves | 151.2 | 131.3 | 205.1 | -21.0 | -31.9 | 1.3 | 108.0 |

| Total Equity | 162.6 | 142.7 | 216.5 | -20.0 | -30.9 | 15.0 | 121.4 |

| Non Current Liability | 54.0 | 36.1 | 8.0 | 2.3 | 6.3 | 16.4 | 2.2 |

| Current Liability | 638.0 | 535.5 | 611.6 | 440.8 | 362.5 | 298.0 | 187.9 |

| Total Liabilities | 692.0 | 571.6 | 619.6 | 443.1 | 368.8 | 314.4 | 190.1 |

| Total Equity & Liability | 854.6 | 714.3 | 836.1 | 423.1 | 337.9 | 329.4 | 311.5 |

Cash Flow Summary

(All Amount in ₹ Crores)

| CASH FLOW SUMMARY | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Operating Activity | -22.0 | 27.0 | -320.6 | -34.5 | -18.3 | -139.0 | -205.3 |

| Investing Activity | 27.0 | -0.7 | -84.8 | 10.5 | 13.2 | 46.6 | -63.4 |

| Financing Activity | 3.5 | 18.0 | 329.4 | 72.6 | -23.2 | 75.1 | 320.7 |

| Net Cash Flow | 8.5 | 44.3 | -75.9 | 48.6 | -28.3 | -17.2 | 52.1 |

Share Holding

Registered Address

ISIN: INE0HLU01028

PAN: AABCO0442Q

601,Good Earth Business Bay, Sector 58, Gurugram, Haryana 122101

Management

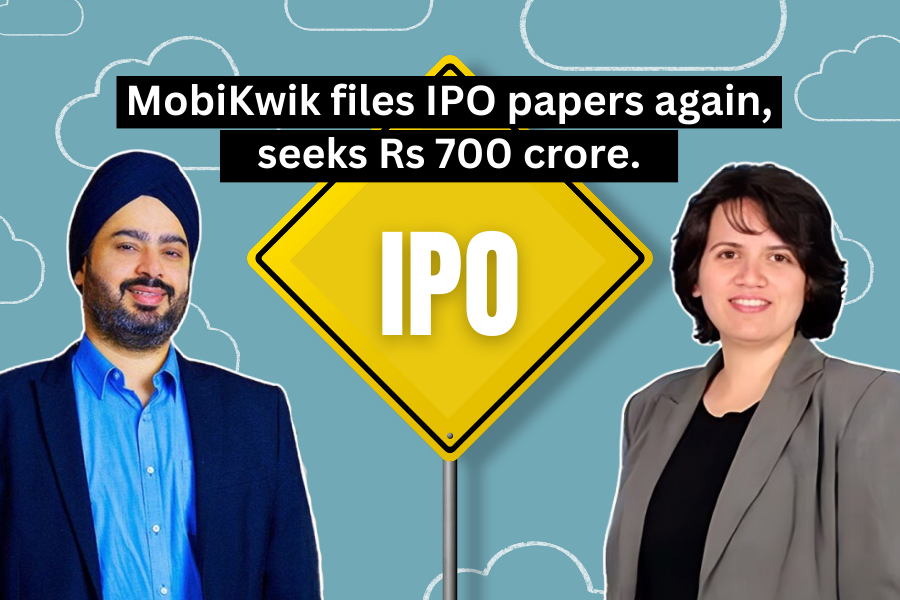

Mrs. Upasana Rupkrishan Taku

chairman

Mr. Bipin Preet Singh

managing director & ceo

Mr. Dilip Bidani

chief financial officer

Mr. Rahul Luthra

company secretary

Download Financial Result

News

MOBIKWIK PICKS MOHIT NARAIN AS COO-CONSUMER PAYMENTS

Need More Profitable Quarters Before Refiling For IPO

MobiKwik posts its maiden PAT, eyes a 35% user growth in FY24

MobiKwik In Talks With Funds, Family Offices For Fresh Fundraise

Mobikwik to be profitable in FY24, Upasana Taku

MobiKwik Reports Rs5cr Profit In Q2, Eyes IPO In June 2024

Mobikwik's Zaakpay gets in-principle nod to operate as payment aggregator

MobiKwik to roll out IPO in 12 months if markets are conducive

Latest Videos

Top Unlisted companies

About Mobikwik Unlisted Shares

One Mobikwik Systems Limited is a digital payments company founded in 2009 by Bipin Preet Singh and Upasana Taku. It offers a mobile wallet to make electronic payments easy for users in India. The range of services offered by the company includes Bill payments, online shopping, grocery delivery, fuel stations, vast retail chains, pharmacies, supermarkets, and more. The Mobikwik platform also supports peer-to-peer payments through UPI and MobiK...

Frequently Asked Questions

How to buy unlisted shares of One Mobikwik Systems Ltd (Mobiwik)?

How to Sell unlisted shares of One Mobikwik Systems Ltd (Mobiwik)?

What is the lock-in period of One Mobikwik Systems Ltd (Mobiwik) unlisted shares?

What is the minimum ticket size for investment in One Mobikwik Systems Ltd (Mobiwik) unlisted shares?

Is it legal to buy unlisted shares of One Mobikwik Systems Ltd (Mobiwik) in India?

Is Short-term capital gain tax applicable on One Mobikwik Systems Ltd (Mobiwik) unlisted shares?

Is there any Long-term capital gain tax to be paid on One Mobikwik Systems Ltd (Mobiwik) unlisted shares?

Applicability of Taxes on One Mobikwik Systems Ltd (Mobiwik) unlisted shares once it is listed?

How to check the credit or transfers of One Mobikwik Systems Ltd (Mobiwik) unlisted shares?

What is the documentation requirement for dealing in unlisted shares?

What are expected returns on unlisted shares of One Mobikwik Systems Ltd (Mobiwik) shares?

What is the complete IPO size of Mobikwik?

What is the face value of One Mobikwik Systems Limited?

Should I expect good returns from Mobikwik Unlisted Shares?

Where can I buy Mobikwik unlisted shares?